If you are curious about the difference between Yearn Finance and Aave, this article is for you. Let’s learn about the two lending platforms with Cove Markets. Check out our Yearn Finance vs Aave comparison to see which is best for you.

Overview

What is Yield Farming?

Yield farming allows you to earn interest on your cryptocurrency, similar to how you would earn interest on any money in your savings account. However, instead of depositing your money in a bank, you lock up your cryptocurrency, called “staking”, for a period of time in exchange for interest or other rewards, such as more cryptocurrency.

What is Aave?

Aave is an open-source, decentralized financial protocol that lets users borrow or deposit cryptocurrencies and earn interest. Aave works through smart contracts that let users borrow from a “liquidity pool” mostly made up of crypto that users have put into Aave. In other words, people who want to borrow money through Aave don’t get loans from specific banks or directly from people. Borrowers pay interest on the money they borrow, and lenders get interested in the money they lend out. Its currency, AAVE Tokens, can be kept, moved, and traded on several crypto exchanges.

What is Yearn Finance?

Yearn Finance is a yield farming platform that makes it easy to earn interest on your cryptocurrency holdings. Yield farming is a process of staking cryptocurrency to earn interest as passive income. Yearn Finance is a decentralized finance (DeFi) tool that aims to optimize yield to generate a higher return. In other words, this platform is an automation tool that invests into the liquidity pools of various projects to deliver the best possible profits.

What Do They Have in Common?

They are both protocols for decentralized lending and borrowing. Both protocols allow users to collateralize their crypto assets to take out loans, and they also allow users to lend their crypto assets to earn interest. However, there are some key differences between the two protocols.

Yearn Finance is a DeFi yield aggregator that allows users to automatically earn the highest yield on their deposited crypto assets. Aave is a decentralized lending protocol that allows users to lend their crypto assets to earn interest and also to take out flash loans.

Yearn Finance Vs Aave: What Are The Differences Between 2 Yield Farming Platforms?

Available Networks

Yearn.finance is a group of protocols that allow users to optimize their earnings on crypto assets through lending and trading services. By running on the Ethereum blockchain, users can take advantage of earning interest on their assets, as well as participating in decentralized exchanges.

Meanwhile, Aave was first built on top of the Ethereum network. All of the tokens on the network, called ERC20 tokens, also use the Ethereum blockchain to process transactions. Since then, Aave has opened more stores, like Avalanche, Fantom, and Harmony.

Read more: Polygon Vs Harmony: MATIC Vs ONE. Which Crypto Is Better In 2023? Which Should You Choose?

Available Coins

About AAVE, AAVE presently supports around 30 different types of crypto assets over 5 different networks.

On the other hand, Yearn Finance – All 36.6K YFI tokens are currently in circulation – that’s 100% of the total supply!

Collateral

Yearn Finance

The “Iron Bank” is the perfect solution for borrowing and lending on the yearn.finance DeFi protocol.

This service can be used by users and protocols to borrow or lend different assets.

Lenders can get overextended with loans. Protocols should be whitelisted to get undercollateralized or zero-collateralized loans. For this, factors such as reputation, track record, smart contract audits, insurance coverage, and treasury value and liquidity are considered.

There are two important factors that must be met in order to receive a loan:

- The Reserve Factor: is the fee paid to the Iron Bank as a percentage.

- Collateral Factor: The most money you can borrow against a particular asset.

Aave

Aave allows users to take out loans against fee-collecting tokens, such as ETH, DAI and USDC. This means users can take out a loan against a position that is earning them revenue, without sacrificing the opportunity cost that comes with taking advantage of crypto lending and borrowing.

APY

Yearn Finance

Yearn Finance: ~0.3% to 35% APY

Yearn Finance (YFI) has a unique yield farming and aggregation tool and a development team that is always coming up with new ways for users to get higher yields. Also, Yearn and Curve Finance work well together. The platform has more than 30 Yearn-integrated Curve pools where investors can put one of five different cryptocurrencies (ETH, WBTC, DAI, USDT, or USDC) into a smart contract that puts the money into the corresponding pool on Curve to earn interest.

The smart contract puts earnings back into the pool, which makes the gains more significant. Yearn has the same risks as the other yield-farming platforms, such as the possibility of loss and the failure of smart contracts.

Read more: TOP 8 Best Stablecoins To Trade & HODL In 2023: A Full Guidance For Beginners

Aave

For staking: Aave offers a 2.73% supply APY for USDT.

For borrowing: Aave offers a 3.68% interest rate for USDT.

Total Value Locked (TVL)

Total Value Locked is a metric that records the total value of assets locked in an ecosystem. The TVL is publicly visible on the blockchain ledger, and analytics websites follow the data for growth statistics.

| Yearn Finance | Aave |

| $512,919,078 | $6,103,020,984 |

Fees

The yearn. finance system charges a 5% fee for its Vaults service and 0.5% on Vaults and Earn. $500,000 of this fee is retained by yearn. finance, with the rest being distributed to YFI holders.

Every exchange has its own set of fees, and Aave is no different. They list their fees clearly so you know what you’re getting into before you begin trading. Thankfully, the fees associated with Aave are minimal; conducting transactions on the Ethereum blockchain means being tied to gas fees, but Aave does not apply fees on top of that.

| Action | Aave fee |

| Minimum deposit | No minimum |

| Flash loans | Variable |

| Transfers | Gas fees only; depends on ETH network |

Security

Yearn Finance

CER.live lays out four essential security standards that all crypto projects should follow: token audit, platform audit, bug bounty, and insurance.

The essential security characteristics of Yearn Finance are:

- Token audit (No)

- Platform audit (Yes, CryptoManiacs, TrailofBits, MixBytes, Quantstamp, CertiK)

- Bug bounty (Yes, Immunefi)

- Insurance (Yes, Nexus)

Audit coverage for Yearn Finance is 100%, meaning that all related systems have been assessed for security. Yearn underwent security audits by five different companies in the past two years and most vulnerabilities were low to medium in severity. Yearn Governance addressed them.

Yearn finance has an active bug bounty from Immunefi but received 6 of 10 because rewards for critical findings do not exceed $500k. Since its launch, Yearn Finance has been hacked for $11m. Yearn Finance holds 85th spot in the DeFi category and 203rd place among all 1,500 cryptocurrencies analyzed by CER.live.

Aave

The team responsible for the protocol seems to have made security their top priority. By constantly checking for vulnerabilities and auditing the protocol, they are able to keep it safe.

Since the protocol is open-source, the code it is based on can be regulated. Through their blog, the team also tries to let users know about changes to their security. The admin keys also help keep the platform safe and run well. About 54 cryptocurrencies have been able to get live feeds thanks to the Aave protocol.

The team offers a very enticing incentive for reporting bugs: a reward of up to $250,000 if the reported bugs and vulnerabilities happen to be critical.

Users

The two protocols are used by a variety of users. Number of Users on Aave has 39k users.

Market capitalization

| yearn.finance (YFI) | Aave (AAVE) | |

| Market Cap (USD) | 319,512,800 | 1,158,076,908 |

| Volume | $61,491,545 | $149,185,170 |

| Rank | 99 | 41 |

| Total Supply | 36,666 YFI | 16,000,000 AAVE |

| Circulating Supply | 36,637.72 YFI | 13,997,307.84 AAVE |

Coin issuance

Since its official launch on July 17, 2020, the Yearn platform has offered a variety of products to maximize yield for its users including governance token and cryptocurrency, YFI. As a “profit switching” lender, Yearn has helped its users earn more on their investments.

About Aave, Aave’s AAVE token is an ERC-20 token that was launched on January 16, 2018. It was distributed in an airdrop to holders of ETH who had deposited ETH into the Aave protocol. A total of 1 billion AAVE tokens were issued in the airdrop, representing 10% of the total supply.

Read more: TOP 10 Best ERC20 Coins To Trade & HODL In 2023: A Full Guidance Of Potential Crypto For Traders

Listing

You can now buy/sell/swap AAVE tokens on:

- CEXs: Binance, Coinbase Exchange, Kucoin, Huobi Global, MEXC Global and many more…

- DEXs: Sushiswap, Uniswap and many more…

Meanwhile, YFI is being traded on Uniswap, Balancer, Binance, MXC, FTX, Hoo, and Poloniex, according to CoinGecko data.

Read more: Best Crypto Exchanges For Trading In 2023: Centralized Exchanges

Developers

Yearn Finance

YEarn.finance, which was previously known as iEarn, was created by a single developer, Andre Cronje. After suffering an exploit in February, 2020, Andre announced he was stepping away from the project after facing backlash from the community. He later returned and the project re-branded to yEarn.finance, introducing a suite of new tools such as Earn, Vaults, yInsure, and StableCredit.

Aave

Aave Team

Stani Kulechov: CEO & Founder: Stani Kulechov is a Finnish programmer, entrepreneur, and the founder of the Aave protocol (formerly ETHLend). Kulechov is primarily active in the cryptocurrency, blockchain, and fintech (financial technology) industries. He is also a member of the Board of Directors of the Ethereum Foundation.

Jordan Lazaro Gustave: COO: Jordan works in the tech industry and has a background in international relations and managing innovation. He has a lot of experience driving innovation by working with government officials and financial institutions.

Backing

- Andre Cronje, the founder of Yearn Finance, is the sole source of funding for Yearn Finance.

- Aave is backed by Carnaby Capital, Matrix CIB, SVK Crypto, and YouBi Capital, which are all well-known investment firms.

Future Projection

Yearn Finance

As part of stage one, these tokens will be used to reward YFI stakers under an xYFI model. In other words, users will stake assets in the xYFI vault and earn YFI from the treasury in return.

Yearn.finance announced that stage 2 will introduce a Curve-Esque vote escrow model. This will incentivize YFI token holders by rewarding them for locking their tokens.

The third stage of the veYFI development plan will introduce the Vault Gauges model to allocate rewards based on voting. In addition, holders of the veYFI token will be able to earn external voting incentives. Finally, the fourth stage will allow veYFI holders to earn even more rewards for their contributions.

The proposed changes to the tokenomics will also affect the governance of the yearn.finance protocols. Only YFI tokens staked in phase 1 or locked in phase 2 would be eligible for use in voting, according to the proposal.

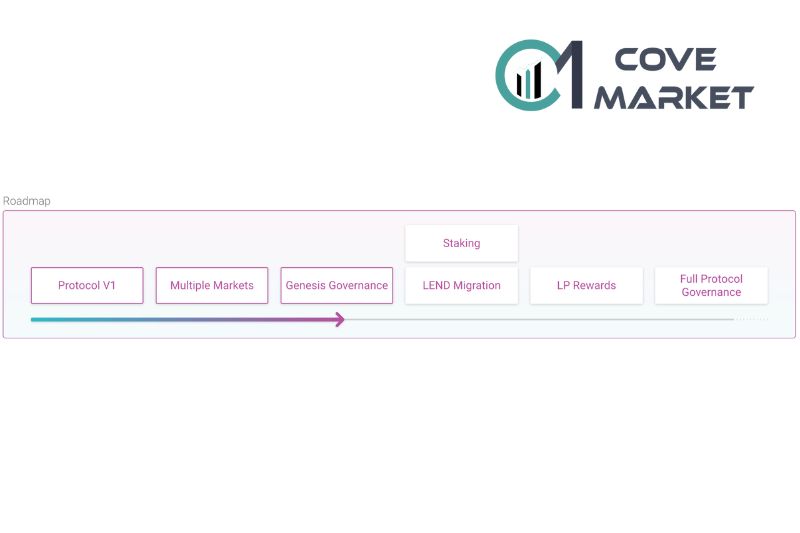

Aave

The goal of the Aave Protocol is to make global money markets for tokenized assets that don’t need permission. This goal was set in motion when the protocol was made public, and it is still being worked on with the recent launch of alternative markets. Governance and the start of Aavenomics are the next steps toward decentralization. The execution plan for Aave and where it is in the development cycle are shown in the diagram below:

At a Glance

| Yearn Finance | Aave | |

| Company Information | Founded: 2020 yearn.finance/ | Founded: 2017 United Kingdom aave.com |

| Ticker | YFI | AAVE |

| Blockchain | Ethereum | Ethereum, Avalanche, Fantom, and Harmony. |

| Categories | Crypto Lending (DeFi), Crypto Staking, dApps, DeFi Projects, Yield Farms | Automated Market Makers (AMM), Crypto Lending (DeFi), Crypto Staking, dApps, Decentralized Exchanges (DEX), DeFi Projects, Yield Farms |

| Training | Documentation | Documentation |

| Support | Online | Online |

| Platforms Supported | SaaS | SaaS |

| Audience | Decentralized Finance for crypto traders. | Platform for anyone interested in earning interest on deposits and borrowing assets. |

AAVE vs YFI: Which Is a Better Investment?

The main difference between Aave and Yearn Finance is that Aave focuses on lending while Yearn Finance focuses on yield farming. When comparing the two, it is important to consider your investment goals.

If you are looking for a platform that offers more lending options, then Aave may be the better choice. However, if you are looking for a platform with more yield farming options, then Yearn Finance may be the better choice.

Where to buy AAVE and YFI?

Yearn Finance Vs Aave are both available to buy on numerous cryptocurrency exchanges. Some of the most popular exchanges that list Yearn Finance include Binance, Kraken, and BitPanda. Some of the most popular exchanges that list Aave include EToro, Crypto.com, Coinbase, Binance.

Read more: Crypto.Com Vs Binance: Which Crypto Exchange Is Better For Bitcoin Traders In 2023

FAQs

What are the risks involved in crypto yield farming?

Here are some of the risks associated with yield farming:

- Risk of Impermanent Loss

- DeFi Smart Contract Risk

- liquidation risk

- Unfairness

- Risk of Scam

- Gas Fees

- Bugs in the Code

- Price Risks

- Strategy Risk

Which yield farming platform should I choose?

If you’re looking to make money with cryptocurrency, check out the list of yield farming platforms below. You’ll find an overview of the best options in the market right now.

- Quint is the best platform for crypto farming in general for 2023.

- DeFi Swap: Get up to 75% APY on DeFi Coin

- YouHodler: Global Trade with Yield Farming

- eToro is a regulated platform with tools for people interested in crypto.

- Crypto.com is a great place to get a high annual percentage yield on stablecoins.

- BlockFi is a well-known Bitcoin yields platform.

- Coinbase is the best platform for beginners to start making money.

Which one is the best coin?

There is no definitive answer to this question as it depends on individual preferences and needs. Some people may prefer Yearn Finance because it offers a higher yield on deposited funds, while others may prefer Aave because it has a lower borrowing rate. Ultimately, it is up to the individual to decide which platform is best for them.

Is Aave or Yearn Finance more popular?

There is no definitive answer to this question as popularity can be subjective. In general, Aave seems to be more popular than Yearn Finance based on various metrics such as social media followers and search engine results.

Why are they so popular?

There are a few reasons why Yearn Finance and Aave are so popular. First, they offer a very user-friendly interface that makes it easy for users to get started with lending and borrowing. Second, they have built up a large community of users who are willing to help each other out and provide feedback. Finally, they have been able to offer very competitive rates on their loans and deposits, which has helped them attract a lot of users.

Where can I learn more about them?

There is a lot of information available on the internet about Yearn Finance Vs Aave. You can learn more about these two companies by searching for them on the internet.

This is the go-to website for all things related to the two platforms.

You can also stay up-to-date on Yearn Finance and Aave by visiting our website. In addition, you can find countless other related news articles to keep you informed.

Conclusion

If you’re looking for the best lending platform in 2023, it’s tough to choose between Yearn Finance and Aave. Both platforms have their pros and cons, so it’s important to decide what’s most important to you. If you’re looking for the lowest interest rates, Aave is the better choice. However, if you’re looking for more flexibility in repayment terms, Yearn Finance is the better option. Whichever platform you choose, make sure you do your research to get the best deal for you.

Disclaimer: The information provided in this article is not investment advice from Cove Markets. Cryptocurrency investment activities are yet to be recognized and protected by the laws in some countries. Cryptocurrencies always contain financial risks.

TOP 10 Best DeFi Coins To Trade & HODL In 2023: A Complete DeFi Lists For Crypto Traders

TOP 12 Best Meme Coins To Trade & HODL In 2023: Waiting To Explode In Future

Sushiswap Vs Uniswap: Which Decentralized Exchange Is Better To Buy Crypto For You in 2023