Fundamental Vs Technical Analysis are two popular methods investors use to analyze securities. Both approaches have their benefits and drawbacks, so it’s essential to understand the key differences before making investment decisions.

This article will provide a comprehensive overview of technical analysis vs fundamental analysis and how they can be used to make informed investment decisions.

An Overview

Regarding addressing the markets, fundamental and technical analysis are two primary schools of thought at different ends of the spectrum. Investors and traders use both to investigate and anticipate future stock values. Both, like every investing technique or philosophy, has supporters and detractors.

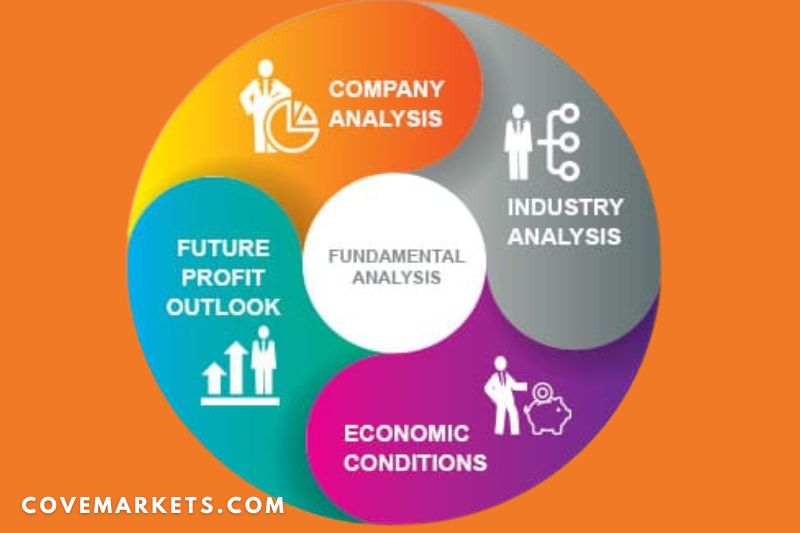

Fundamental Analysis

This analysis is used to assess stocks by trying to calculate their intrinsic worth. Fundamental analysts research everything from the broader economy and industry circumstances to particular firms’ financial soundness and management. Fundamental analysts scrutinize earnings, costs, assets, and liabilities.

Technical Analysis

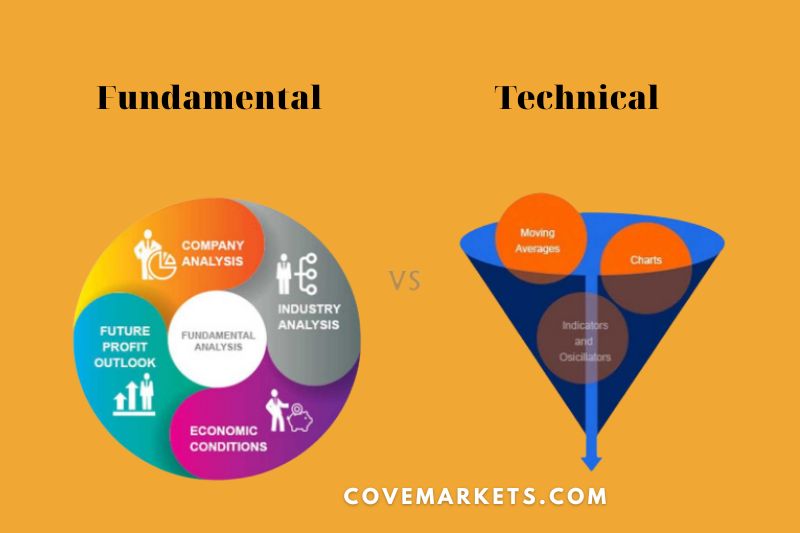

The analysis technique varies from the techniques of fundamental analysis in that traders seek to spot opportunities by examining statistical patterns such as price technical analysis and volume changes in stock. The underlying premise is that all known fundamentals are priced in. Hence there is no need to pay careful attention to them.

Technical analysts do not try to calculate the inherent worth of securities. Instead, they utilize a wide range of analysing tool to spot chart patterns and trends that indicate how a stock will perform in the future.

Definition of Fundamental Analysis

Fundamental analysis of stocks carefully evaluates the fundamental variables that drive the economy, industry, and company’s interests. Its purpose is to determine the true intrinsic worth of a share by assessing economic, financial, and other elements (both qualitative and quantitative) to find opportunities where the share’s value differs from its current market price.

The basic analysis evaluates all of the elements that can influence the value of the security (including macroeconomic and organization-specific factors), which are nothing more than financial statements, management, competition, business idea, and so on. It examines the overall economy, the industry it belongs to, the business environment, and the company itself.

It is based on the idea that these stock fundamentals have some lag in impacting share prices. So, in the short term, stock prices do not reflect their worth, but in the long term, they adapt. It is a three-stage examination of:

- The Economy: To examine the country’s overall economic situation and condition. It is examined using economic indicators.

- The Industry: To estimate the prospects of different industry classifications using competitive industry analysis and industry life cycle analysis.

- The Company: Determine the firm’s financial and non-financial features to determine whether to purchase, sell, or hold the company’s shares. Sales, profitability, and EPS are examined, as well as management, company image, and product quality.

Definition of Technical Analysis

Technical analysis is used to predict the price trends of a share, which states that the price of a company’s share is determined by the interplay of demand and supply factors in the marketplace. It is used to anticipate the future market price of the stock based on the share’s historical performance information. To do this, the stock price changes are first determined to predict how the price will vary in the future.

The price agreed upon by the buyer and seller of the share is one such value that combines, weighs, and reflects all of the considerations and is the only value that counts. In other words, technical analysis methods provide a clear and thorough picture of the reasons behind price fluctuations in an asset.

It is founded on the assumption that share prices move in trends, i.e., upward or downward, depending on the traders’ attitude, psychology, and emotion.

Tools used for Technical Analysis

- Prices: The change in the price trends of securities reflects the investor’s attitude as well as the demand and supply of securities.

- Time: The degree of price movement is a function of time, i.e., the time necessary to reverse the trend determines the price change.

- Volume: The transaction volume that defines a price shift might reveal the size of the change. The change is considered insignificant if there is a change in the price of shares but just a little change in the transaction volume.

- Width: The quality of price change is determined by determining if the change in trend is scattered throughout numerous sectors or is unique to a few securities alone. It represents the extent to which changes in the prices of securities have occurred in the market by the general trend.

Traders usually implement trading indicators such as Moving Averages (MA), RSI, Bollinger Band to forecast price actions and future prices of the markets

Fundamental Vs Technical Analysis: Key Difference Between Fundamental And Technical Analysis

Time Horizon

In general, fundamental analysis invests for the long term, while technical analysis invests for the short term. While market prices charts may be shown in weeks, days, or even minutes, fundamental analysis often examines data across many quarters or years.

Fundamentally oriented investors may have to wait long for a company’s inherent worth to be reflected in the market. For example, value investors often believe that the market is mispricing security soon but that the stock price will correct itself in the long run. In certain circumstances, the “long run” might signify many years.

Investors that favor fundamental research depend on quarterly financial statements and changes in profits per share that do not occur daily, such as price and volume data. After all, broad changes cannot be implemented immediately, and it takes time to develop new products, marketing campaigns, and other methods to turn around or enhance a corporation.

Fundamental-trading analysts utilize a long-term time frame partly because the data they use to study a company is produced considerably more slowly than technical analysts’ price and volume data.

Trading vs. Investing

The aims of technical analysis and fundamental analysis are often different. Technical analysts often attempt to uncover several short- to medium-term transactions in which they may flip the best stock fundamental analysis. Still, fundamental analysts typically attempt to make long-term investments in the underlying company of a stock by analyse economic factors. A simple approach to understanding the distinction is to imagine someone purchasing a property to flip vs. someone buying a home to live in for many years.

The Critics

Many detractors see analysis technical as either unfounded or wishful thinking at best. Do not be shocked if these naysayers doubt the discipline’s legitimacy to the point of mocking supporters. While most Wall Street analysts concentrate on fundamentals, several businesses also hire technical analysts.

Much of the criticism toward technical-investing centers on the Efficient Market Hypothesis (EMH), which asserts that any previous trade information is already represented in the stock price.

Taken to its logical conclusion, the “strong form efficiency” theory asserts that both technical vs fundamental analysis is meaningless since all market information is accounted for in a stock’s price. Author Burton G. Malkiel shows this idea in his book A Random Walk Down Wall Street by describing how to analyse a company for investment is better at guessing than stock selection.

In actuality, the EMH remains just that—a hypothesis. Investors must develop their mindset and choose which techniques will work best for them.

Can They Co-Exist?

Fundamental analysis vs technical analysis is frequently considered opposed to examining stocks, although some investors have succeeded by combining the two.

An investor, for example, may employ fundamental study to discover an inexpensive stock and technical analysis to determine an entry and exit point for the long-term investment. This combination often works best when a security is oversold, and joining the position too soon might be detrimental.

Alternatively, some technical traders may look at fundamentals to back their trade. For example, a trader may look for a breakout around an earnings release and analyze the fundamentals to see if the stock is likely to outperform earnings.

Some related posts:

- Layer 1 Vs Layer 2 Vs Layer 3: Blockchain Scaling Solutions Need To Know 2023

- Crypto Vs Stocks: Is It Better To Buy Crypto Or Stock? Full Guide 2023

- Cardano Vs Solana 2023: Top Full Comparison For You

FAQ

What is better than fundamental or technical analysis?

Fundamental analysis is more theoretical since it aims to establish a security’s long-term worth. Technical analysis is more realistic since it analyses markets and financial instruments as they exist, even if trade activity seems illogical to predict the chart patterns.

Does Warren Buffett use technical analysis?

Warren Buffett dislikes technical analysis because he believes it is ineffective. Warren Buffet does not use and will never use technical analysis. Warren Buffett defines fundamental investing as “owning a piece of a firm” (the stock).

Is technical analysis useless?

Technical analysis is not worthless in trading, as some claim. It is effective when combined with other indications. Technical analysis is based on price patterns from the past. They do not foretell how prices will change in the future, but they assist us in understanding how prices may fluctuate and forecast the cash flows from whales.

Do financial Advisors use technical analysis?

Financial adviser and broker license examinations address technical analysis briefly. However, comprehending its vital function in today’s public markets requires more research.

Conclusion

Two main types of analysis are used in the stock market: fundamental and technical. Fundamental analysis looks at a company’s financials to determine its value, while technical analysis uses past price movements to predict future activity. Both have pros and cons, but which is right depends on your investment goals and style. Thanks for reading!

Disclaimer: The information provided in this article is not investment advice from Cove Markets. Cryptocurrency investment activities are yet to be recognized and protected by the laws in some countries. Cryptocurrencies always contain financial risks.

Day Trading Cryptocurrency: The Best Strategies for Success

Cryptocurrency Arbitrage Trading: A Guide to Trading Strategies

TOP 12 Best Altcoins To Trade & HODL In 2023: Best Trading Coins For Beginner