If you’re wondering what is risk averse, this blog post is for you. Covemarkets discuss the advantages and disadvantages of being risk averse, and whether or not it’s a good thing.

What Is Risk Averse?

Risk averse is a word used to describe the degree of risk you are ready to tolerate while discussing investing plans. An investor who avoids taking substantial risks in their investments is referred to by the phrase.

When investing, you must decide how much risk you are willing to accept in exchange for the possibility of larger profits. This article will define risk aversion and provide instances of risk-averse investments.

Risk aversion is the tendency to avoid risk. The word risk-averse refers to an investor who prefers capital preservation over the possibility of a higher-than-average return. In the investment world, risk equals price volatility. A volatile investment may either make you wealthy or deplete your funds. Over time, a sensible investment will increase slowly and gradually.

Risk aversion is the tendency to avoid risk. The term risk-averse describes the investor who chooses the preservation of capital over the potential for a higher-than-average return. In investing, risk equals price volatility. A volatile investment can make you rich or devour your savings. A conservative investment will grow slowly and steadily over time.

Understanding Risk Averse

The term risk-neutral refers to an individual’s approach toward investing choices that focuses exclusively on possible returns regardless of risk. That may appear counterintuitive—evaluating reward without considering risk appears to be inherently dangerous.

Nonetheless, when presented with two investment options, the risk-averse investor considers just the possible rewards of each investment while ignoring the potential downside risk. The risk-averse investor will forego the chance of a significant return in favor of safety.

Risk-Averse Investment Choices

Risk-averse investors often put their money in savings accounts, certificates of deposit (CDs), municipal and corporate bonds, and dividend growth stocks. Except for municipal and corporate bonds and dividend growth equities, all of the above nearly ensure that the money invested will be there when the investor decides to cash it in.

Dividend growth stocks, like any other stock, fluctuate in value. They are noted for two primary characteristics, however: They are shares in established firms with proven track records and a consistent stream of revenue, and they pay a dividend to their owners on a regular basis.

This dividend can be paid to the investor as a supplement to their income or reinvested in the company’s shares to help the account expand over time.

Risk-Averse Attributes

Risk-averse investors are frequently referred to as conservative investors. They are unable to accept volatility in their investing portfolios due to nature or circumstance. They prefer that their assets be very liquid. That is, the money must be there in whole when they are ready to withdraw it. There will be no more waiting for the markets to rise again.

Older investors and retirees are the most risk-averse. They may have spent decades accumulating a nest egg. They are hesitant to risk losses now that they are utilizing it or want to use it soon.

Risk-Averse Investment Examples

Risk-averse investors prefer investment options that are recognized for their consistency and minimal volatility. Examples of lower-risk investments for the risk-averse person include:

Savings Accounts

A savings account is a sort of financial account provided by a bank, credit union, or another form of financial organization that holds the owner’s money and provides a predetermined interest rate as well as a secure storage option for saved monies.

Savings accounts often provide modest but consistent growth, allowing account holders to receive interest in return for maintaining their cash in the account. Some savings accounts contain limits on how frequently withdrawals can be made or on the minimum account balance.

A high-yield savings account from a bank or credit union offers a consistent return with little to no investment risk. Funds stored in these savings accounts are insured up to generous amounts by the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA).

However, the phrase “high-yield” is relative. The rate of return on investment should be equal to or slightly higher than the rate of inflation.

Certificates of Deposit (CDs)

A certificate of deposit, often known as a CD, is a financial product issued by banks, credit unions, and other financial organizations that offers a high interest rate in return for a set term duration and withdrawal date.

Investing in a CD can give a better return than other low-risk investment options, but the money deposited is not available until the withdrawal date is agreed upon. Risk-averse investors who don’t need their money right now might put it in a certificate of deposit.

CDs often give somewhat higher interest rates than savings accounts but require the investor to keep the money in the account for a longer length of time. Early withdrawals are permitted, but they are subject to penalties that may wipe out any income from the investment or even eat into the capital.

CDs are especially handy for risk-averse individuals who wish to diversify their cash holdings. That instance, people may put some of their money in a savings account for easy access and the remainder in a longer-term account with a higher return.

Money Market Funds

Money market funds are mutual funds that invest in high-quality short-term debt securities, cash, and cash equivalents. These funds are extremely low-risk, with each fund share always being worth $1.00. Because they are conservative, they tend to pay relatively low rates of interest to investors.

Bonds

A corporate bond is a debt security issued by a corporate firm and sold to an investor. This sort of bond is often a longer-term investment option, with a maturity date of at least one year. An investor who acquires corporate bonds lends money to the business issuing the bond in exchange for the firm’s legal promise to repay the investment plus interest when the bond matures.

Treasury securities, or debt issued by the United States federal government, are regarded as the safest of all securities. Investors can purchase Treasuries through mutual funds or exchange-traded funds (ETFs), or directly through the government’s TreasuryDirect website.

The global financial crisis of 2008-2009 was exacerbated in part by the failure of bonds backed by subprime mortgages.

Notably, the agencies tasked with rating those bonds should have assigned them ratings that reflected the risks of the investments. It was “junk bonds” disguised as safe bonds. Bonds issued by stable governments and strong firms are preferred by risk-averse investors. Their bonds have received the highest AAA grade.

In the worst-case bankruptcy scenario, bondholders have first dibs on repayment from the proceeds of liquidation. Municipal bonds offer a distinct advantage over corporate bonds. They are often excluded from federal and state taxes, which increases the overall return to the investor.

Dividend Growth Stocks

Dividend growth stocks are investment opportunities that pay dividends to investors or regular payouts of their earnings to their shareholders. Dividends are often paid out by publicly listed firms in order to reward its investors for investing in the company.

A dividend growth stock investment opportunity is considered less hazardous than other types of stock investment possibilities because investors may expect regular distributions from the firms in which they invest, sometimes on a timetable established by the company that delivers the dividends.

Dividend growth companies may appeal to risk-averse investors because their consistent dividend payments help offset losses even when the stock price falls. In any event, corporations that raise their yearly dividends every year do not often exhibit the same volatility as equities bought for capital appreciation.

Many of these are stocks in so-called defensive sectors. That is, the enterprises are consistent earners who are not as adversely affected by an overall economic slowdown. Examples are companies in the utilities business and companies that sell consumer staples.

Investors often have the choice of reinvesting dividends to purchase further shares of stock or receiving immediate payment of the dividend.

Permanent Life Insurance

Permanent life insurance products like whole life and universal life come with cash accumulation features, tax advantages, and living benefits that make them attractive for risk averse investors.

A life insurance policy’s cash value never loses value and rises over time. Policyholders can withdraw or borrow from the cash value at any time (however this may affect the death benefit amount).

How to Measure Risk Aversion?

When calculating risk aversion, consider your own sentiments about taking chances in your personal and financial lives. Risk aversion can change over time, and the willingness to take on more risk may shift based on your experiences with taking or avoiding risks. To assess risk aversion in investing, follow these steps:

Absolute risk aversion

One method for measuring the level of risk an investor is willing to accept is known as absolute risk aversion. The Arrow-Pratt measure of absolute risk aversion is a formula that generates a curve; the larger the curve, the more risk-averse the individual is when selecting investment options.

This formula, commonly known as the coefficient of absolute risk aversion, is named after John W. Pratt and Kenneth Arrow, two economists who investigated risk aversion.

The formula is: A(c) = -u”(c)/u'(c)

When using this method, you may compare constant absolute risk aversion (CARA) to hyperbolic absolute risk aversion (HARA) (HARA.) HARA is one of the more generalized classes of utility functions used to calculate risk aversion.

Relative risk aversion

The Arrow-Pratt risk aversion metric may also be used to calculate relative risk aversion, or RRA. It employs a new algorithm to determine how much risk an investor is prepared to contemplate and accept in their portfolio.

The formula is: R(c) = cA© = -cu”(c)/u'(c)

Portfolio theory

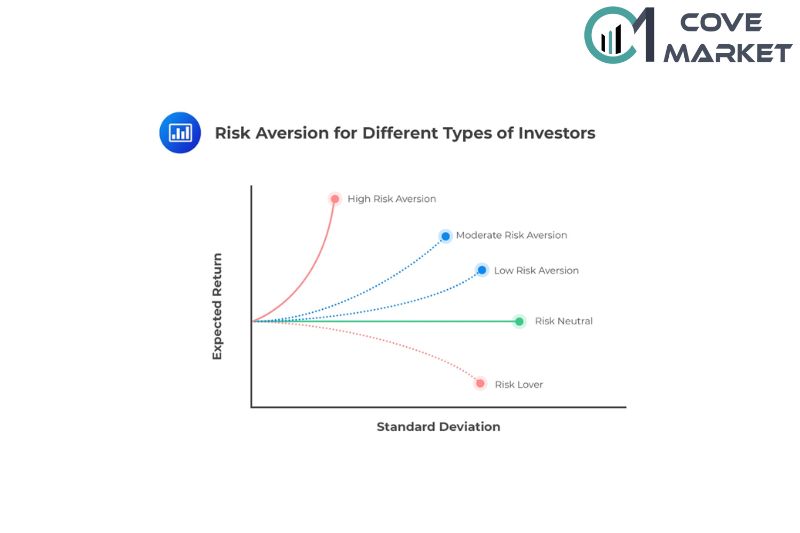

Today’s portfolio theory provides a less sophisticated approach to risk aversion by measuring the standard deviation of the return on investment, or the square root of its deviance. Risk aversion in this method of calculation looks at the potential expected reward an investor would need to accept more risk.

Risk Averse Investment Strategies

In addition to particular assets or asset classes that appeal to risk-averse investors, there are a variety of risk-averse investment methods that may be used to limit losses.

One method is to diversify your assets. Diversification entails including assets and asset types that are not significantly associated with one another.

This manner, you are not placing all of your eggs in one basket, and if certain stocks fall on a particular day, others may increase to balance those specific losses. Diversification helps you to optimize your projected return while decreasing your overall portfolio risk.

Another technique is income investing, which focuses on keeping bonds and other fixed-income instruments that produce regular cash flows rather than capital gains. Investment income is especially beneficial for retirees who no longer have job income and cannot sustain market losses.

Other hazards associated with income investment include inflation and bad credit occurrences. Bond and CD laddering, as well as inflation-protected securities, can help reduce the overall risk of your fixed income portfolio.

Advantages and Disadvantages of Being Risk Averse

Exhibiting risk aversion means to shy away from risk, and in terms of investing means avoiding risky securities. Individuals who are risk averse should look for assets and methods that meet their low risk tolerance.

As a result, one advantage is that the chance of loss is reduced. Investing in low-risk assets such as fixed-income securities may provide guaranteed cash flows as well as consistent positive returns over time.

On the downside, risk aversion can also lead to missed opportunities. People who are too risk averse may avoid investments that could pay off handsomely or miss out on experiences that could be enriching. Furthermore, money sitting inert in savings or “under the mattress” loses purchasing value over time as it is eroded by inflation.

| Pros | Cons |

|

|

FAQs

Which Types of People Are More Risk Averse?

According to research, people’s risk aversion differs. People’s risk aversion can vary depending on a number of factors, including their age, their financial situation, and their personal preferences. However, some research has suggested that women, older adults, and low-income individuals tend to be more risk averse than other groups.

Are women more risk averse?

people’s risk aversion varies depending on a number of factors, including their personal experiences, beliefs, and values. However, some research suggests that women may be more risk averse than men, on average.

Particularly when it comes to financial decisions. Other research has found that women are more likely than men to take precautions to avoid risks, such as wearing a seatbelt when driving.

What product a risk-averse investor would prefer to invest in?

A risk-averse investor would prefer to invest in a product with little to no risk, such as a money market account, a CD, a savings account or a government bond.

Is It Good to Be Risk Averse?

Being risk averse is a double-edged sword. For some people, being risk averse may be the best option. This is especially true if they have a limited amount of resources and cannot afford to lose any of them.

On the other hand, others may find that taking risks can lead to greater rewards. This is often the case for people who are willing to take on more risk in order to achieve their goals.

How Can I Tell If I Am a Risk Averse Investor?

Some common signs that you may be a risk averse investor include:

- You have a low tolerance for losses

- You are more comfortable with predictable, steady returns

- You prefer investments that are less volatile

- You are willing to sacrifice potential upside in order to avoid downside risk

Is Risk Aversion the Same As Loss Averson?

Risk aversion is not the same as loss aversion. Risk aversion is a preference for a certain outcome over a less certain one, while loss aversion is a preference for avoiding losses over acquiring gains.

Conclusion

In conclusion, being risk averse can have its advantages and disadvantages. It all depends on the situation and what you are trying to achieve. In some cases, it may be good to be risk averse, while in others it may not.

Ultimately, you will need to weigh the pros and cons of each situation and make the decision that is best for you.